CareMount/Optum Doctor Confirms Open Secret: ‘Primary Care is Falling Apart’

Opinion Advocates for ideas and draws conclusions based on the author/producer’s interpretation of facts and data.

Same-Day Care Denied

Same-Day Care Denied

Urgent Need for Reform

Inside this week’s Stone’s Throw investigation:

- Insider confirms significant exodus of CareMount providers

- Doctor shortage detailed

- Access denied for same-day appointments

- Local leadership shakeup

- Noncompete ban gains governor’s attention

- More documents from Attorney General’s office obtained

- ‘Double billing’ allegations mount

- Residents decry greed fueling medical decisions

- 10 percent of U.S. doctors now linked to Optum/United

- Physician alleges coercion over Medicare Advantage

- Leaked survey revisited

- Physicians fear retribution

- Optum’s expanding influence

- Unnecessary lab tests encouraged by corporation

- New Optum policy delays mammogram, screening results

Call to Action: Time for Physicians to Speak Out

This is the 10th installment in an investigative series about CareMount/Optum, broader local healthcare issues and corporate medicine.

By Adam Stone

If you’re a patient with CareMount/Optum who ever felt under the weather in recent years, and wanted to see your primary care doctor, only to be shooed away, you may have wondered whether the preposterous inability to secure a simple same-day appointment with your personal physician was part of a cunning corporate strategy or the result of something less sinister.

Well, we now have our answer, and it isn’t pretty.

But before diving deeper here in what feels more like a book chapter than a newspaper column, let me share this: After a year of trying, I’ve finally developed a high-level local doctor source inside of CareMount/Optum ready to corroborate long-rumored details.

The physician helped paint a clearer picture of what’s really unfolding within the walls of the medical group, including a disturbing recent exodus of beloved local doctors, which we’ll get to in a little bit.

“Primary care,” the esteemed doctor dramatically told me last week, “is falling apart at Optum.”

As for patient scheduling specifically, Optum deliberately changed CareMount’s existing system after taking control of the organization’s infrastructure.

“We used to be able to reserve several office visit openings a day for those that call in the morning who need a sick visit,” my doctor source said. “Optum did away with this availability to be sure every single time slot possible was booked up to several days in advance, thus ensuring maximum patient visits for max profits.”

‘Complete Failure’

– Veteran CareMount/Optum Doctor

What happens as a result? Patients who call for same-day sick visits, asking to see their doctors, are instructed to visit urgent care instead.

“They often wait several hours to see a different provider leading to very poor patient satisfaction and maximum patient frustration,” my source pointed out.

As a widely-respected, seasoned physician dating back to the MKMG days, the doctor wants you to know the view shared by “all” of his colleagues – a profits-over-patients culture permeates Optum’s pores with revenue generation trumping healthcare treatment considerations at every turn.

Unlike the past, when “providing adequate financial support for doctors and staff” had been the local hallmark, the doctor said he and his fellow physicians fear for the “future of medical practice at Optum.”

Under Optum, when patients have a mammogram or a breast ultrasound, the radiologist is “no longer allowed to come talk to the patient and tell them the results before they depart,” my doctor source also confirmed about an unsettling new policy. “They must wait for a letter up to a week later. Women are furious over this.”

No one is naive here to the fact that healthcare is and needs to be a business. However, the shift of money moving from its role as a prevalent factor into becoming the primary and often the sole consideration has given rise to an insidious new reality.

“We are all disappointed in the complete failure of the current Optum administration to provide the necessary tools and resources for excellence in the practice of medicine,” the doctor told me. “We feel disrespected, undervalued and unsupported as doctors and support staff who are tasked with caring for so many of our patients who have been with us for decades.”

Cold Feet

– Non-Optum Local Doctor

In reporting out this series over the past year, and sketching a portrait of the local healthcare scene, the most unsettling revelation for me has been discovering the darkness of Optum/UnitedHealth’s corporate culture and the depth of its influence inside our communities and throughout the country.

Despite its hundreds of thousands of wonderful healthcare workers – 90,000 physicians alone are linked to this fungal infection of a sick care syndicate, triple the 30,000 doctor total of 2018 – the company continues to reduce people to dollar signs with a shameless bottom-line approach.

But the organization’s mushrooming political power and increasingly grotesque approach to diagnostics doesn’t only infuriate and scare patients. The corporation’s expanding sphere of influence in medicine has also cowed providers into compliance and silence.

An eye-popping estimate of 10 percent of U.S. physicians are now affiliated with this healthcare kingdom, as the company lured an astonishing 20,000 additional doctors into its lair this year alone.

Over the last 12 months, several area clinicians approached me about voicing on-the-record concerns, before suffering last-minute cold feet. (That said and as noted, I did gather reporting this week from a new anonymous CareMount/Optum insider; more of those compelling revelations a bit later.)

Fear of Retribution

Many have shared their testimony on background after toying with the idea of speaking out publicly.

They want to diagnose this metastasizing cancer of corporate control over your medical care – over your body – but fear the repercussions of openly and unabashedly addressing the crisis.

While the hesitation is more than understandable, it’s also undoubtedly true that silence or tacit consent to fear tactics serve as the strongest allies to malevolent man-made forces – whether in healthcare, or any corroded corner of society requiring accountability.

But here’s the thing: It’s not just the clinicians trapped inside Optum who fear for their jobs and the corporation’s broader wrath. It’s also doctors who don’t even work there.

On Thanksgiving morning, one such specialist e-mailed me, fed up with Optum and the broader healthcare scene.

Advantage Optum

The specialist chronicled coercive maneuvering by the organization, detailing in a phone interview last week how her practice felt compelled to join the Medicare Advantage panel under implicit threat of losing patient referrals.

– Veteran CareMount/Optum Doctor

Medicare Advantage, established in 2003, is health insurance offered by private companies and approved by Medicare.

Rather than the government directly covering your healthcare costs, it pays these companies to handle your coverage.

The plan includes hospital and medical insurance, and it comes in different types, each with its own rules about where you can get medical services and how much you’ll pay.

However, after I spoke with the doctor over e-mail, text and phone, she ultimately decided she couldn’t attach her name to her own story.

“I don’t want the people at Optum – I mean, I don’t think individual doctors will be upset – but I think the administration will be upset because it’s going to come across as we’re saying something negative about them,” said the veteran local specialist, whose spouse is also an area doctor. “And I don’t want us to not be able to, again, not to get patients, to be honest.”

21st Century Doctoring

You truly can’t blame her, especially since she’s in the diminishing and practically heroic ranks of independent practitioners still somehow resisting the professional, financial and administrative benefits of corporatization.

Keeping a healthy balance sheet as a middle-class doctor in 2023 with a modest medical practice remains many miles harder than it might appear from the outside looking in.

The evolution from fee-for-service to Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) compelled doctors to accept diminishing payment rates negotiated by insurance companies.

Initially, the incentive for joining these networks in decades past was to secure a patient base. But, over time, doctors found themselves facing financial challenges as reimbursement rates declined.

“All the CEOs are making lots and lots of money and people don’t really have sympathy for doctors anyway,” the local physician told me. “They think they’re all rich and get paid lots of money, but the doctors have been getting paid relatively less over time when you adjust for inflation and our overhead and malpractice insurance and everything else has gone up.”

Andrew Witty, the CEO of UnitedHealth Group, Optum’s corporate father, was paid more than $20 million last year, a 13 percent increase from 2021.

Power Play

Without revealing her identity, the doctor was willing to disclose details of how larger healthcare organizations throw their weight around and bully solo practitioners.

She also characterized the past behavior of MKMG/CareMount – before it became part of the Optum behemoth – as “even worse than you think.”

“My practice was essentially forced to be on the Optum Medicare Advantage panel in order to continue getting referrals from Optum to see their patients,” she said of the big-footing effort. “This would apply to patients that require referrals to see specialists.”

Failure to join would come with consequences. The practice would not be able to “continue to treat the patients we had been treating for years, and with whom we had developed wonderful relationships,” the doctor explained.

The most blatantly offensive aspect of Optum Health’s existence is that it’s owned by the world’s largest insurance company, UnitedHealth Group, which hatched the subsidiary in 2011, integrating the company’s pre-existing pharmacy and care delivery services.

To give you a general sense of UnitedHealth’s status as a planetary heavyweight in the space, just consider its market capitalization of about $508.95 billion, richer by itself than Austria’s entire gross domestic product.

United Health Corporation, founded in 1977, has benefited incalculably from the type of crony capitalism (on steroids) that is pilloried by both the ideological left and right alike. (The UnitedHealthcare division is probably best known to consumers, with its insurance products and related services.)

In 2005, UnitedHealth purchased PacifiCare, a health plan, and later separated its pharmacy benefit manager, naming it Prescription Solutions, now known as OptumRx.

The company’s up and down, left and right vertical dominance of the marketplace has continued to expand.

Context

UnitedHealthcare’s Medicare Advantage plan covers hospital stays, doctor visits and prescription drug coverage.

In 2022, UnitedHealth Group, the nation’s largest Medicare Advantage provider with 7.6 million enrollees, earned $257 billion in premium revenues, marking a 13 percent surge from the prior year.

But routine denial of essential care by these plans now pose multiple threats, including the survival of struggling rural hospitals across the country, NBC News reported a little over a month ago.

Moreover, United’s shameless healthcare/health insurance conflict of interest would be like if the coach of the Knicks also officiated the team’s games. Patients are left to question if their prescribed game plan is drawn for their benefit or for the insurer’s scorecard.

“They set the rates, the insurance company sets the rates for the reimbursement, but then they also own the group that they’re paying,” the non-Optum independent local doctor bemoaned. “It’s all in the same family. So I don’t see, regulatory-wise, how that is allowed.”

The company is also heavily invested in data analytics.

‘Conflict of Interest’

In terms of pushing patients into certain private plans, the doctor said the corporate nudge is not rooted in what might be best for individuals and their specific circumstances. Optum/United, she stressed, doesn’t care about what’s “really the best plan for the person.”

“They are encouraging – I don’t know by what means – that their Medicare patients go into their Medicare insurance plan, which may not be the best plan for that patient, but they’re making money at both ends,” the doctor said. “They’re making money as the medical provider that will get paid by the insurance company, and then they’re making money as the insurance company [through] that person’s health insurance premiums.”

She said the company pushes eligible patients to its private plan “so they will make even more money on the billing” because Medicare Advantage charges a greater amount than traditional Medicare for providing care “while showing no improvement in outcomes and no cost savings to the government.”

The physician’s husband, also a local specialist, said he believes our healthcare system is “unfortunate, the whole situation.”

“I think the doctors aren’t happy, the patients aren’t happy,” he said. “I guess the insurance company is happy…Seems that a bunch of [doctors] are retiring at that first opportunity.”

I asked the specialist to elaborate on his thoughts about one massive multinational conglomerate running an insurance empire, a healthcare business and offering data analytics services, not to mention a pharmacy benefits management outfit through OptumRx.

“That’s what I think is a conflict of interest,” he said. “I don’t know how that’s legal. I just don’t think that should be allowed.”

Even the federal government has seemed powerless to restrain United’s command over the medical sector. In March, the Justice Department abandoned an appeal against the company’s $8 billion acquisition of Change, a healthcare technology operation.

The Insider

As mentioned in the opening, I was also able to communicate last week with a local CareMount/Optum doctor, through an intermediary source, marking a significant breakthrough in this yearlong reporting effort.

A general practitioner with a sterling reputation, the physician appeared to find it incredibly therapeutic to finally share meaningful details with the general public about area providers fleeing the group practically en masse.

While pinning down exact numbers has been difficult in recent months, overwhelming anecdotal evidence already appeared to illustrate a significant and escalating volume of CareMount physician resignations.

But my new source confirmed a long list of refugees, and helped clarify some of the related statistics.

The physician said local concerns are mounting over Optum’s management of internal medicine doctor departures. At least a half-dozen or so practitioners recently left or will be leaving in the coming months.

“There might be a few leaving who I’m not aware of,” the doctor added while also noting that internists treat at least 2,000-plus patients.

In fact, later in the interview, he began to indicate the number could be well beyond a half-dozen resignations: “As I look closely on the list,” he explained, “I believe I missed a few of those who are supposedly leaving. That would include two from Jefferson Valley.”

‘Evil Clutches’

There are about 77 internal medicine doctors at the legacy CareMount operations in Westchester, Putnam and Dutchess counties.

From what I can gather, it appears that between 10 and 15 percent of the 2023 CareMount/Optum internal medicine doctors crew – at least – might be gone well before the spring of 2024, just a few months away.

That total does not include the more recently-acquired practices in New York City and the Bronx where there are another 20 internal medicine doctors.

Within the larger Optum Tri-State group established last year, there are “several thousand total doctors with its evil clutches,” the doctor said of the company.

Many patients, numbering in the thousands, are currently left without an assigned primary care doctor, my source said, raising questions about the adequacy of Optum’s succession planning.

The source also revealed that some doctors had informed Optum of their departure six months ago or more, yet replacements have not been secured.

“Patients were notified with a simple e-mail that their doctor will be leaving at such [and] such a date and here is a list of a few doctors that have open practices or here’s a link to the website to find a new open practice,” the physician explained.

Patients might receive official communication only about a month to six weeks before a doctor’s departure, even when Optum knows of a resignation half a year or more in advance.

The Firm

For example, patients received an e-mail notice from Dr. Dana Murphy on Nov. 15 about a planned Dec. 31 escape from Optum.

“I know that change can be difficult,” Dr. Murphy stated in corporately-filtered e-mail, emblazoned with Optum’s orange logo, “but there are many board-certified, experienced physicians at Optum and I feel confident that you will do well with any of my amazing colleagues who follow our tradition of delivering the highest quality medical care.”

But my source said patients will be forced to book basic appointments “many months later.” The notion of “open doctors” referenced in the letter does not match with the plain English reality patients confront.

Internist Dr. Paul Gamarnik, another local favorite, is also leaving the Mount Kisco division.

“These two, Murphy and Gamarnik, are and were wildly popular and loved physicians in the Mount Kisco area,” the physician said.

Additionally, another widely-admired local provider, Dr. Paul Gregory Mangiafico, recently announced he’s leaving internal medicine at Optum for early retirement, my source confirmed.

My insider said Mangiafico “wanted to work more years, but could not stand the Optum system and management.”

Breaking News

Just this past Friday, after our initial correspondence, my source learned that Dr. Barbara Alpert, a nearly 30-year veteran internist, is also leaving soon.

She is “going to be working for Northwell in lower Westchester,” my source said. “Another big loss.”

A trio of doctors are leaving the Putnam County offices, the general practitioner noted.

Also, five radiologists have resigned in just the past six months.

“Another major loss,” the source remarked.

While he didn’t have many details about specialists, he did confirm that a rheumatologist, Dr. Ronen Marmur, is resigning soon.

“Dr. Marmer [is] well-established, another severe loss,” he said of Marmur, who sees patients in Mount Kisco and in Putnam.

‘Unknown Circumstances’

The group lost a well-established cardiologist, Dr. Richard Keating, this past spring “because he couldn’t stand the administration,” my source said.

“They couldn’t find a replacement for him until July and the cardiology department is stressed out having a hard time fitting in new patients,” he added.

Adding further chaos, on Sunday my source also confirmed that he “just heard” that Dr. Shawn Tocidlowski, who does family medicine, was suddenly “gone for good.” He “departed under unknown circumstances.”

“Another Optum primary care physician gone,” the doctor said. “A few thousand without a doctor tomorrow.”

At least two other department doctors are also slated to leave next year, too.

Corporate Prescribed Blood Work

Patients seeking new primary care physicians face significant hurdles, with reported wait times of up to four to six months (and sometimes considerably longer) for new patient appointments, my doctor source explained when discussing the issue in greater detail.

“This is ridiculous,” the frustrated physician remarked in an e-mail.

Specialists are also incredibly hard for patients to see in person.

Furthermore, as I reported in an earlier column, Optum’s recent decision to grab revenue by unnecessarily trying to screen the entire internal medicine patient population for hepatitis C and diabetes has sparked controversy.

This one aspect of the story by itself should be a scandal.

The automatic blood orders for these screenings, implemented without consulting physicians and announced by sending patients opaquely-worded e-mails, left people concerned about potential billing issues if insurance denies coverage for unneeded tests not ordered by their primary care physicians.

Patients began to call, concerned whether insurance would cover tests not ordered by their physician.

“I imagine patients might get bills for blood work their physician did not discuss with them,” the doctor said.

Just this week, on Monday, a patient shared a related mass email they received, as the company masqueraded the revenue fishing expedition as prudent, individualized medical advice: “You have open lab work due. An appointment is not required. Examples of lab work include blood draw, specimen collection, EKG, and pre-surgical testing including COVID testing. Please Click here for Lab hours and locations.”

The doctor also elaborated on a story I broke last month – the mass distribution of ColoGuard cancer screening tests and related data privacy concerns.

“Neither my wife nor I had requested Cologuard,” Mount Kisco resident Michael Kleff told me at the time. “And also, our family doctor confirmed on inquiry that he had not arranged to have Cologuard to be sent to us.”

Optum didn’t even notify primary care physicians about the seedy marketing push.

“There are several instances of false positives, and many instances of this being not needed as patients just had recent colonoscopies,” my doctor source stated. “Ridiculous.”

Theory of the Case

Local Optum shops are also struggling to find replacements for open positions, my physician source confirmed.

“Big picture right now is there are so many primary care doctors leaving the group, and those who have left recently and Optum cannot find replacements despite ongoing recruitment efforts,” he said.

Recruitment difficulties may stem from the increasingly unfavorable commentary online about Optum, the general practitioner speculated.

“I suspect those new doctors who have finished residency and are looking for their first job in primary care are likely Google searching reviews on Optum, and are horrified by what they see,” he theorized.

Optum is having difficulty attracting well-trained medical doctors, potentially leading to the recruitment of nurse practitioners to fill the gap, the doctor said.

While stressing how he has “nothing against nurse practitioners,” it’s simply not the same as seeing a doctor, the seasoned provider observed, also predicting that the available primary care physician talent Optum does hire “will be inferior for sure.”

“The feeling among some of us remaining primary care physicians is that Optum would like to hire an army of nurse practitioners to replace all the doctors who have left and are leaving,” he said. “They could pay these nurse practitioners a fraction of what the doctors are currently paid, but still get the entire reimbursement from insurance for a nurse practitioner visit, as would be paid to an M.D.”

Patient Rebellion?

I was struck by the fact that the doctor forecast a definitive fallout from the organization’s vulgar efforts to “clearly and dramatically [increase] profits for the corporation.”

The blunt reality is that the company’s duplicitous behavior does offer other local healthcare players a colossal business opportunity, even as Optum’s bean counters might celebrate slashing costs.

My physician source calculated that there are about 176,600 CareMount/Optum patients – many now potentially up for grabs. He believes local healthcare consumers won’t continue to stand for the nonsense.

The doctor framed it this way: “Will they accept a so-called physician extender to replace an M.D. who has more substantial training and experience? No, and I anticipate thousands and thousands of patients leaving the Optum practice for other local groups, such as Northwell and Nuvance.”

Patient populations at the so-called CareMount legacy locations, now owned by Optum, vary across regions, with about 60,000 patients in Mount Kisco, 22,500 in Fishkill and 16,000 in Poughkeepsie.

There are also roughly 20,200 in the Putnam/Carmel region, 15,000 in Rhinebeck, 14,500 in Jefferson Valley, 14,000 in Yorktown, 7,500 in Katonah, 4,500 in Somers and 1,400 in Briarcliff, my source said.

Next Friday is Hawaiian Shirt Day

The corporate atmosphere and use of comically cringey internal PR has also rankled doctors.

Last Thursday, leadership held a “Tri-State Day of Gratitude,” and encouraged physicians to “take pictures, create memories, and let the spirit of appreciation shine through.”

“Apparently all the bigwigs are going to walk around the offices and talk to the staff about how much they are appreciated,” my irritated source communicated last week through the intermediary.

It’s hard to hear that and not conjure images of the Bill Lumbergh character from “Office Space” holding court, with demeaned, accomplished doctors sheepishly eating sorry-looking slices of cake.

My physician source also shared an e-mail message sent just last Thursday by CareMount Medical’s leadership: Chief Executive Officer Kevin Conroy, Interim Chief Medical Officer Dr. Jill Brodsky and Chief Operating Officer Alex Kordonsky.

In the letter, the executives note that recent feedback from staff form the foundation of a comprehensive action plan they are developing to address concerns.

“We recognize there is a lot still to do; some things will take time and we may not be able to solve everything,” the trio wrote. “But one thing is for sure, we can solve a great deal by working together.”

You Never Write. You Never Call.

As much as improvement seems eminently possible, I have to wonder (even if local executives hold the best of intentions) how much control CareMount’s leadership team enjoys in relation to the Minnesota-headquartered corporate bosses from on high.

It’s hard to believe they maintain all that much more power over the massive Optum/United machine than the physicians possess.

They’re all agents of Optum/United’s breathtaking corporate power, a much more potent institutional force than any good or bad individual actors. Fundamental fixes won’t come easy.

But they must try. (My e-mail and phone are open portals for your insights too, local execs. Be in touch.)

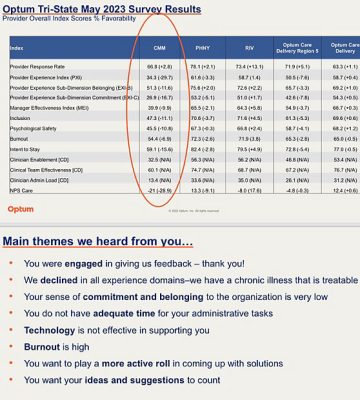

Back in May, a different doctor source I communicated with briefly through an intermediary provided me with an internal survey that chronicled the deep dissatisfaction among clinical staff.

“We declined in all experience domains – we have a chronic illness that is treatable,” an executive summary acknowledged.

Not sarcastically: The first step toward resolution is recognition. Kudos to Conroy on that one.

Opposite Day

Conroy, the Optum Tri-State CEO, did publicly address myriad concerns in a February letter sent to the community.

He announced that the company would work to fix the atrocious call center, a problem area that helped fuel my initial coverage a year ago.

“The old CareMount billing department issues have certainly not been resolved, never mind the continual phone problems and long telephone wait times,” Bedford Corners resident Jennifer Saine, a discontented local patient who encouraged us to cover the story before anyone else, told me around this time last year. “I feel like my family is trapped in a quickly-collapsing system. I have stayed because our doctors are excellent, and we value their expertise, but how long will they even be able to endure being stretched so thin?”

Amidst growing criticism on these pages and across social media, Conroy, in that letter, pledged enhanced service by extending hours, forming a patient advisory council and, most notably, through adding physicians.

He said the company would be “increasing the number of physicians and advanced practice clinicians on our care team to provide you with additional opportunities to see our clinical team.”

The opposite appears to be the case, even if outside of Conroy’s control. But he does seem to be shaking things up.

Buh-Bye

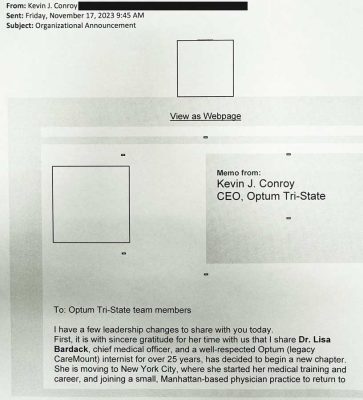

Dr. Lisa Bardack, CareMount’s chief medical officer with more than a quarter-century of experience at the firm, recently left for a Manhattan-based practice. (Bardack has been reported to be Hillary Clinton’s longtime physician.)

Also, Dr. Rich Morel was switched from his role as president and regional chief medical officer to focus on direct patient care at CareMount’s Mount Kisco campus.

The major internal personnel news (announced in a Nov. 17 e-mail from Conroy that I reviewed last week) was unveiled after the physicians completed their assessments and reviews of the local legacy CareMount/Optum leadership on Oct. 31.

“My colleagues and I clearly feel the review was so poor for the current leadership that Dr. Bardack and Dr. Morel were asked to step aside,” my doctor source said. “We don’t think they had a choice about moving on.”

I’d like to ask company representatives for their perspective on the doctors’ hypothesis – and ask them about this entire local healthcare hullabaloo – but they stopped replying to my requests for comment earlier this year.

I don’t personally believe there is a human boogeyman in this story. If there’s any central villain, it’s an amorally programmed Frankenstein-like medical institution, wreaking systemic havoc with a cunning mind of its own.

The state Attorney General’s spokesperson has also declined to accommodate my requests for comment. (But, in fairness, Letitia James’ office appears to be letting FOILed documents do the talking. Details in just a bit.)

‘It’s Really Terrifying’

Local social media pages also continue to explode with comments about CareMount/Optum.

One Croton-on-Hudson area patient wrote last week about her husband seeking an appointment for an urgent medical need, only to discover that their regular doctor was unavailable until January.

Attempting to accommodate the patient, the company scheduled an appointment with another physician in the office, and the woman’s husband arrived on time for an 11 a.m. appointment.

“He ended up leaving, without the doctor seeing him, at 12:51 (p.m.),” the local woman recounted. “He sat in the waiting room for 90 minutes and then sat in the exam room for another 20 without being seen and had to get to work, he had lost his entire lunch break and buffer and he didn’t get the help he needed.”

Local residents have also grown increasingly aware of the acquisition of doctor’s practices by predatory private equity firms, leading to cutbacks and increased charges.

A study released in July by the American Antitrust Institute reported that more than half of specialists in certain U.S. markets are owned by these investment entities.

“They target must-see services like doctors and veterinary offices because people can’t avoid those,” an area patient posted to a local social media page. “It’s really terrifying.”

‘Hay’ Now

The narrative arc of our regional medical group’s evolving history of the past two dozen or so years is also worth examining, to understand the broader context of recent local developments.

My anonymous non-Optum local doctor source (the one who described the Medicare Advantage issue) highlighted (entirely unsolicited) who exactly had been running CareMount during the period of industry transition of the past generation: OB/GYN Dr. Scott Hayworth, Optum Tri-State’s president.

“His wife is Nan Hayworth, who was our congresswoman,” the source observed. “So it’s, you know, kind of interesting.”

Interesting indeed.

One of my earlier pieces in this series discussed CareMount Medical’s lobbying efforts to influence New York State’s healthcare regulations, particularly regarding the Department of Health’s (DOH) Accountable Care Organization (ACO) regulations and their potential impact on Medicare.

An ACO is a collaborative healthcare approach where providers work together, ostensibly to improve patient care and control costs – and cash in.

CareMount Value Partners IPA, under Optum’s roof, boasts of being “a leading provider of value-based care.”

(On Nov. 17, my Freedom of Information Law request to the DOH for records related to CareMount’s ACO lobbying was denied, with Records Officer David Harvey writing that documents were “withheld” due to the Public Officer’s Law as “inter-agency or intra-agency materials.”)

Dr. Nan Hayworth, a Republican, was elected to office in November 2010, and became a prominent congressional voice in the call to reshape Medicare. She’s now linked to Pilot Growth Equity (a technology growth firm), and titled as a Business Development Advisor.

“…I voted to protect the Medicare trust fund, preserve Medicare Advantage and let seniors and their doctors – not bureaucrats – make the decisions about their healthcare,” Hayworth stated in a 2012 TV campaign ad.

Whatever one might conclude about government-run Medicare’s issues (its financial challenges are real, if exaggerated for effect) and the role of private industry in any reform effort, the congresswoman’s direct personal connection to the issue cast a shadow over her perceived interests.

Sly Fox

Mount Kisco resident Judith Sage, who is active in local Democratic politics, campaigned against Hayworth in 2010, when she unseated then-Rep. John Hall, and worked against her again two years later, canvassing for Sean Patrick Maloney in his successful challenge.

Sage was inspired to resist Hayworth’s ascension because of the Medicare issue.

She recounted an anecdote about a Hayworth visit to the local senior center.

“Someone told me that she went to Fox Center and said, ‘I’m going to save Medicare by privatizing Medicare,’” Sage recalled in a phone interview last week.

The veteran activist lamented patients dealing with rejected bills and limited access to essential services.

Sage said she’s starting to embrace the policy notion of “Medicare for all.”

“I don’t believe that for-profit Medicare is doing anyone any good,” said Sage, who is 76. “I think people, you know, I feel people are dying because of it. They’re not getting adequate care.”

‘Urgent Care Healthcare System’

Even before Mount Kisco Medical Group, founded in 1946 (and later nicknamed MKMG) was rebranded as CareMount Medical in 2016, Sage said she saw the handwriting on the wall, and began finding new doctors well in advance of the current exodus. But it’s not easy to do, with limited options and emotional attachments.

“I began removing doctors one by one,” she said. “Like every year or two, I would take another doctor away. And it wasn’t until the very end practically that I took my primary doctor away because that was very hard to do. But I began disassociating myself with the group well before anybody else.”

A different local patient contacted me about three weeks ago to share her concerns but asked for anonymity because of her ongoing relationship with the group.

Once she “heard through the grapevine that her doctor was leaving,” she jumped on the phone to get an appointment with an internist but couldn’t get in until March, at the Katonah office.

“That was the earliest time,” she said. “And I said to them, ‘What happens if I get sick? Who do I call?’”

Because it has become basically impossible to get a same-day appointment with your primary care doctor, local healthcare has devolved into an “urgent care healthcare system,” the Northern Westchester resident and widely known longtime local business owner said.

Beyond Optum urgent care facilities, the systemic issues have also strained Northern Westchester Hospital at times. Last December I reported how the emergency room was facing increased congestion due to the intentional scheduling issues, with frustrated patients turning to the ER for non-emergencies.

“The recent acquisition of CareMount Medical by Optum has also left many patients seeking treatment at the (Northern Westchester Hospital) ER rather than waiting to see their primary care physicians, many times for non-emergent health issues,” Mount Kisco Village Trustee Lisa Abzun said at a Dec. 19 board meeting last year.

You can also draw a straight line between the coarsening culture of healthcare companies – a distressing trend with a good quarter-century of history now – and the harrowing fallout for patients.

In April, I published a piece about a local woman who was denied her medical records and healthcare access from the group after her daughter died as a stillborn. The Katonah resident, Rachel Krause, was banned by CareMount following a dispute, as was her husband, Sam Newbold.

“I’m just astounded that he had experience with OB/GYN and that they would do this to someone with the risks I had postpartum,” Krause said at the time about Dr. Scott Hayworth. “To me, that seems so inhumane, unethical, dangerous. I thought that by contacting him, he would be able to help improve the situation.”

Laying Down the Law

Last year, when CareMount Medical, ProHEALTH Care Associates and Riverside Medical Group were combined to create Optum Tri-State, it was the culmination of a multiyear effort to establish the new entity.

As I learned in my reporting earlier this year, 264 CareMount shareholders – the healthcare group’s doctors – relinquished their ownership stakes and agreed to become employees of Optum on Dec. 4, 2020, although many veteran physicians chose retirement instead.

The impact of local doctors transitioning from stake-holding owners to subordinate employees can’t be overstated, with the ability of area physicians to push back on problematic administrative decisions now severely numbed.

Back in January I obtained key portions of an onerous 31-page employment contract the doctors signed. It shockingly stipulated that doctors (if they resign) are prohibited from practicing medicine within a 20-mile radius of their primary office location for three long years.

“The new owner has drastically reduced our salaries,” a different anonymous, longtime CareMount/Optum doctor told me at the time. “Now you want to leave, but you’re trapped. It’s wearing people down.”

An effort by state lawmakers to ban noncompete contracts – the legislation passed the Assembly in April – has recently gained momentum.

At an unrelated press event two weeks ago in Manhattan, Gov. Kathy Hochul, seemingly mindful of the interconnected healthcare issue, referenced a possible compromise on eliminating non-compete clauses in New York, proposing that the ban apply only to workers earning more than $250,000.

“The other thing I have to balance is making sure that we don’t drive businesses from our state because there isn’t a competitive environment,” Spectrum News 1 reported Hochul concluding at the Nov. 30 press conference.

Record Check

In recent months, I’ve also been reporting on documents I obtained from the state Attorney General’s Office through the Freedom of Information Law (FOIL).

Records reveal a Health Care Bureau at the AG’s office troubled by CareMount’s lack of cooperation and byzantine (at best) billing system, a vexing local problem that far predates Optum’s menacing grip.

The FOILed documents are filled with complaints from patients about alleged double billing by CareMount.

“Double billing is fraud, they are collecting payment from Medicare, the supplement insurance carrier and then receive payment from the patient,” Jan Greenbaum, the operator of the Brewster-based Greenbaum Insurance Services, LLC, told me last month for an earlier report.

The Health Care Bureau, which assists patients with problems accessing care or getting insurance coverage, also investigates industry operators that might be operating illegally.

“If we find that a business is violating the law, we get remedies for New Yorkers, including refunds and changes in behavior,” the bureau states online.

Last Wednesday night, the latest haul of digital documents rolled in – 104 new pages of CareMount condemnation. (Check out the records on a special landing page on our website.)

While some of my past pieces went deep into the documents, let me just give you the nutshell description this week on some of the latest, since I’ve already spilled way too much ink.

Cliffs Notes

Consumer complaints to the Health Care Bureau included in the documents reveal more billing discrepancies, confusion over charges, payment concerns and further inquiry into the provider’s practices.

The bureau appears to be scrutinizing how CareMount arrives at questionable amounts included in its bills to patients.

“Clarify the way charges and the amount due is calculated,” Health Care Bureau Helpline Advocate Derek Jones instructed CareMount in an Aug. 25, 2022, e-mail when helping to resolve a patient complaint.

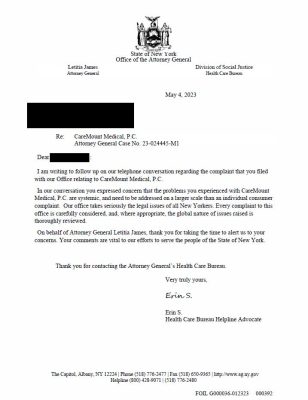

Another bureau advocate, Erin Signer, sent a letter on May 4 that referenced how a complainant cited concerns about CareMount that are structural in nature.

“In our conversation you expressed concern that the problems you experienced with CareMount Medical, P.C. are systemic, and need to be addressed on a larger scale than an individual consumer complaint,” Signer wrote. “Our office takes seriously the legal issues of all New Yorkers. Every complaint to this office is carefully considered, and, where appropriate, the global nature of issues raised is thoroughly reviewed.”

The company’s COVID-19 billing practices also face scrutiny from the Health Care Bureau, with patients alleging irregularities and encouraging a deeper investigation.

Signer, the helpline advocate, sent a follow-up letter to CareMount on Oct. 11, 2022, seeking clarity on why a patient might be absorbing COVID test charges.

“It was my understanding that Medicare recipients were not to be billed for COVID testing which is what [a] patient is disputing for 7/29/2021,” Signer wrote to CareMount in a portion of one letter I published in September.

On Nov. 22, 2022, Signer expressed her dissatisfaction with the nature of one of the healthcare company’s replies.

“The e-mail thread does not appear to be addressing our inquiry or the bill, but instead has some information about coding which I am not familiar with,” Signer wrote to CareMount. “Please provide a detailed response which explains if the bill remains valid and why the patient is eligible to be billed for an office visit for a COVID test.”

‘Beyond Wrong’

The documents from James’ Health Care Bureau also include correspondence between patients and the healthcare company directly.

For instance, in a Nov. 29, 2022, e-mail, a patient expressed frustration over unresolved billing issues, alleging unjust charges while recounting a lengthy ordeal involving tedious attempts to rectify the situation.

In a page-long description of the circumstances, the patient cited concerns over potential credit damage and the impact on their future medical care.

“I’ve been a patient at CareMount for over 15 years,” the patient wrote. “To treat someone like this, especially when this is a cancer screening, is just beyond wrong.”

I’ll dig through the correspondence in more detail in the coming months – and I’d encourage you all to do the same on our website.

Assistant Attorney General Abisola Fatade, the office’s records officer, also confirmed last week that additional documents should be hitting my inbox on or about Feb. 6.

More Evidence?

A local Medicare beneficiary reached out to me last week (and took to a local social media community page) to raise eyebrows over her Medicare statement. She discovered that Optum had listed routine blood pressure measurements during doctor visits, both systolic and diastolic, as billable services.

While the statement did not specify an amount for these services, they were subsequently rejected with the following explanation: “This item or service was denied because information required to make payment was incorrect.”

“I might be making a mountain out of a molehill but still this is weird and happened for two different doctors,” the patient said.

Separately, another local patient publicly reported about CareMount/Optum’s billing system being “the absolute worst.”

“The past two bills we got from them included the copay that we paid,” the patient posted on social media. “This happens almost every time we have a doctor visit. Always ask for receipt after paying copay. And yes, calling to correct their mistakes is time consuming and frustrating. I wonder how many people pay these incorrect charges? I love my doctors, not ready to change, but the system has always been bad.”

‘Tip of the Iceberg’

Last month, I also heard from a retired area internist who possesses intimate knowledge of some of the past inner workings of CareMount as a result of his various relationships.

A former private practice physician, he described a web of systemic billing misconduct in the healthcare industry, asserting that the issues I highlighted in my prior reporting on CareMount barely scratched the surface of a deeply-rooted problem.

“Double billing is fraud, they are collecting payment from Medicare, the supplement insurance carrier and then receive payment from the patient.” – Jan Greenbaum of Greenbaum Insurance Services, LLC

The doctor said he’s “old-school” and “amongst the company of many” who believe the “old way of teaching medicine and practicing medicine and managing the industry has to come around full circle soon.”

“Otherwise,” he continued, “the bullet train of high-tech is going to run off the rails and the twisted aftermath of that is going to be on the healthcare consumer who’s going to get shortchanged, over and over and over again.”

This particular non-Optum, retired doctor might reveal his identity and go on the record with me in the coming weeks.

As much as the doctor appreciated my reporting on CareMount’s questionable billing practices, he emphasized how there’s a much bigger story simmering.

“In other words, what I’m trying to say is, these billing issues [are] only the tip of the iceberg,” he stated.

As a board-certified internist and clinical instructor of medicine, he said he was losing more than 63 percent of his “intellectual property into the pockets of others over decades.”

“Yes,” he also conceded, “I’m sore and I’m mad and these methods of seizing Medicare and Medicaid dollars just doesn’t get old.”

Oh, Canada

Close followers of this column space know I’ve promised for a couple installments now to focus on local policymakers, and their response to the healthcare turmoil.

But I keep getting interrupted by new reporting, and it happened here yet again.

To be clear, the delay has not been the result of “no comments” from officials but rather my gravitating toward information shared by my new insider sources.

That said, I’m especially interested in the views of Congressman Mike Lawler (R-Pearl River), given his status as a rare swing district Republican, straddling a delicate political line between appealing to both moderates and conservatives.

He wasn’t available for a phone interview in recent days but Examiner Editor-in-Chief Martin Wilbur and I have an in-person hour-long session scheduled for next week at the congressman’s local district office.

The topic of policy prescriptions to address our fractured healthcare system will be front and center.

‘Six Months in Advance’

Although government inefficiency can certainly rival corporate greed in a competition over unpleasant outcomes, there’s one prominent defense of American style healthcare that might eventually fade from prevalence.

When analysts trumpet the benefits of, say, universal medicine in Canada, defenders of the U.S. status quo often point to the delays our neighbors to the north sometimes endure, with wait times for national healthcare appointments stretching to almost 28 weeks on average, according to a 2023 study.

But given the difficulty so many Americans now confront when seeking to schedule routine visits themselves, that line of argument, while still relevant, has lost some of its punch.

“I make my annual physical six months in advance,” Wilbur told me last week, referring to his non-Optum provider in northern Westchester.

In my neck of the northern Westchester woods, most people I know don’t even bother trying to establish contact with their regular doctors when they’re sick.

For better or worse, it’s straight to urgent care for seemingly everyone.

Doctors in Our Borders

Lawler, for his part, did introduce the Doctors in Our Borders Act in July.

It aims to address a physician shortage by expanding what’s called the Conrad 30 Waiver Program, allowing states to issue 100 waivers to foreign medical graduates, vying to retain top-tier talent in the U.S.

Because many of the issues at play here are systemic in nature, over and above CareMount/Optum/United’s specific shortcomings, Lawler appears to be on a helpful track with this particular piece of proposed legislation.

In a July 27 press release, the congressman cited a projected shortage of more than 120,000 doctors by 2034.

He characterized his proposed legislation as a “good first step in tackling the shortages many New Yorkers have seen in medical facilities across the state.”

“It is essential that we act now to stave off disaster and ensure continued access to care,” stated Lawler, who sits on the House Financial Services Committee, which has jurisdiction over economic issues, including insurance.

“In our conversation you expressed concern that the problems you experienced with CareMount Medical, P.C. are systemic, and need to be addressed on a larger scale than an individual consumer complaint.” – Attorney General’s Office Health Care Bureau Helpline Advocate Erin Signer

Inflection Point

Optum’s command over our care is expanding and expanding quickly.

This year alone, the top physician employer in the country rebranded clinics, faced scrutiny over layoffs, acquired the LHC Group home care firm for $5.4 billion, and added nearly 2,000 employees for revenue cycle management and IT services.

Just north of our coverage area, UnitedHealth has also quietly boosted Optum’s potency with the acquisition of the Hudson Valley/lower Catskill area doctor group Crystal Run Healthcare. News of the purchase only came to light thanks to reporting in February by the Mid-Hudson News.

The healthcare organization is now part of the Tri-State Optum group, and no longer owned by physicians, just like CareMount.

“Crystal Run has long recognized that the fee-for-service reimbursement model is broken, and we committed to transition to value-based care…,” CEO Dr. Hal Teitelbaum announced at the time in a letter to colleagues.

But that’s not all!

The company also merged with Amedisys, Inc. in a $3.26 billion deal that gave the organization control over one of the largest home health and hospice care providers in the United States.

Here locally, we’re starting to see the dam break in terms of public demand for action, with residents taking to the Nextdoor social media platform again last week to specifically drumbeat for advocacy.

One post I saw passionately called for legislative intervention, with the author sharing the contact information of local elected officials, encouraging area patients to push the cause.

I have to assume the phone lines of some local lawmakers were ringing last week.

‘90% Error Rate’

If you have a hunch that somehow the bigger picture here relates to our escalating descent into AI-powered healthcare and insurance services, your gut is more than onto something.

We’ve barely started chapter 1 in the artificial intelligence meets healthcare story: how the intersection of emerging technologies and medicine/insurance will bifurcate human patients from non-human decision-making.

Just last month, UnitedHealth Group was hit with a proposed class action lawsuit alleging its AI algorithm, nH Predict, systematically denies elderly patients’ claims for essential extended care, leading to out-of-pocket expenses for medically necessary services.

The lawsuit, filed by family members of deceased beneficiaries, aims to represent a nationwide class on Medicare Advantage plans, potentially involving tens of thousands of people and seeking damages in the billions.

The legal action contends that UnitedHealth’s use of the algorithm violates contracts and insurance laws, portraying AI as prioritizing corporate interests over people’s well-being.

UnitedHealth uses the algorithm to “prematurely and in bad faith discontinue payment for healthcare services,” the complaint said, as Reuters reported.

An early adapter, Optum has been investing significant resources in AI, machine learning and natural language processing for many years.

“This is an example of how AI is being utilized not to help people but to line the pockets of corporations and their shareholders,” Ryan Clarkson, founder of the law firm representing the plaintiffs, said to Reuters in a published report.

“The past two bills we got from them included the copay that we paid.” – Local Patient

I found a copy of the lawsuit online, and the details are chilling.

Here’s how the plaintiffs, a pair of estates, introduce their argument to U.S. District Court in Minnesota: “This putative class action arises from Defendants’ illegal deployment of artificial intelligence (AI) in place of real medical professionals to wrongfully deny elderly patients care owed to them under Medicare Advantage Plans by overriding their treating physicians’ determinations as to medically necessary care based on an AI model that Defendants know has a 90% error rate.”

Um, this is a problem.

‘Just Not Worth It’

In a satirical take on healthcare dynamics that recently went viral on Facebook, a weary solo practitioner meets with UnitedHealthcare, expressing the desire for fair reimbursement only to be swiftly dropped from the network.

The video, headlined “Family Medicine Negotiates with [UnitedHealth],” highlights the shift toward corporate-owned physicians and the loss of autonomy in the face of Optum’s influence.

“Can you just pay me what Medicare pays me instead of 50 percent less than that?” a beleaguered looking doctor sheepishly asks.

The same actor then plays the part of the corporate suit.

“Well, we used to negotiate with solo practitioners like yourself, but we did a cost-benefit analysis and it’s just not worth it,” he tells the exhausted physician.

“I’m sore and I’m mad and these methods of seizing Medicare and Medicaid dollars just doesn’t get old.” – Non-Optum Retired Doctor

Oprah’s Couch Awaits

The video does an entertaining job of encapsulating the problems. But what about the solutions?

Prescribing the right remedies is far harder than identifying the obvious symptoms.

That’s why we really need healthcare providers to articulate what patient-centered reform should look like. They know best with their view from within the belly of the beast.

I do have a little media and strategy pro tip for doctors reading this who want to make a difference, leveraging the power in numbers: Form a small coalition, identify your desired change, develop a tidy message, craft an open letter, solicit legislators to join you, arrange a press conference and summon mass media outlets.

Don’t worry, I won’t be the only journalist there. (I happen to know Bloomberg News and The New York Times are already sniffing around this story.)

Your insider account advances to another level once it hits TV airwaves, and the pages of national newspapers. It can save lives.

The public nature of your activism could help safeguard you from company blowback. And the grateful fanfare from everyday people might stun you. (A book deal and daytime TV appearances also wouldn’t be far behind.)

Under Oath

Given the gravity of the current situation, speaking out about these offenses right now should be seen as an extension of a doctor’s Hippocratic Oath.

“In purity and according to divine law will I carry out my life and my art,” a less famous portion of the oath beautifully reads.

Silence is doing real, concrete, immeasurable, long-term harm.

The power of free markets to help create incredible healthcare breakthroughs over the past 75 years has been genuinely remarkable – with surgery, with vaccines, with pharmaceuticals, with medical equipment and much more.

Just last Friday, the FDA approved groundbreaking gene therapies, Casgevy and Lyfgenia, for sickle cell disease treatment in patients 12 and older, a milestone for the Boston-based Vertex Pharmaceuticals and CRISPR Therapeutics.

But the market controlling your doctor is not a free one. It’s a corrupt and closed market.

Science is advancing but doctor access is receding.

This new normal is undoubtedly fatal.

Last Word

While patients, by and large, remain deeply grateful for the wonderful, life-saving work healthcare practitioners continue to deliver on a daily basis, including at Optum, we wish clinicians could provide quality care because they work for a healthy organization, not in spite of working for diseased one.

As for me, even though I remain in awe and profoundly appreciative for the miracles of modern medicine and life-saving surgical advances, this year’s reporting has led me to distrust (on a whole other level) the corporate infrastructure that engines U.S. sick care.

Thankfully, I’m in good health. But I have my first meeting with an area energy healer this Friday after reporting about Reiki three weeks ago. I also scheduled an initial consultation for this Saturday with a local naturopathic doctor.

These are words I couldn’t have imagined thinking, let alone writing, even six months ago.

I plan to explore, both personally and professionally, how to complement the best of conventional Western medicine with Eastern modalities for more holistic healthcare, including through medical bill-mitigating preventative measures. (People live till about 85 years old in Japan on average as compared to just over 76 in the angst-ridden U.S., a staggering difference.)

This story is a business story at its core.

If policymakers are unwilling to address the flawed marketplace supply and our treasured doctors are unable to risk their jobs to speak up, it’s up to us patients, us healthcare consumers to redirect the demand.

To break the fourth wall here, let me also speak directly to local doctors: Every cause needs a leader. Physicians liberating themselves from corporate constraints to spearhead a movement for compassionate care is a noble battle worth instigating.

Someone needs to step up.

How about you?

Adam Stone is the publisher of Examiner Media. E-mail him at astone@theexaminernews.com with tips and feedback.

Adam has worked in the local news industry for the past two decades in Westchester County and the broader Hudson Valley. Read more from Adam’s author bio here.